“Unprecedented!”

“The calm before the storm!”

“A source of nervousness!”

These were just a few words senior leaders of the credit union movement used to describe the current business environment, which we call “Business As Unusual.” This distinguished panel included:

- Paroon Chadha, Co-Founder and CEO, Passageways

- Bob Falk, CEO, Purdue Federal Credit Union

- Dean Pielemeier, President & CEO, Abbey Credit Union

- Erin Coleman, Senior Director, Advisory Services, Filene Research Institute

- Amit Seru, Steven and Roberta Denning Professor of Finance, Stanford Graduate School of Business

2021: Predicting the Unpredictable

There is a saying: “It is often said there are two types of forecasts: lucky or wrong.” Nevertheless, each of the panelists was asked to offer one prediction they see coming true by the end of 2021. Here’s what they said.

Please note: a full recap on the event can be found here.

- “I think you’re going to see an extreme ramp-up of consolidation. There are absolute capital drain and capital impactful type of issues that are headed our industry’s way, and that’s going to drive immense consolidation in both the credit union and banking industries. It’s won’t just be about small credit unions merging into bigger credit unions. It’s going to be shops like my billion and a half credit union [Purdue Federal Credit Union] with another billion and a half or 2 billion credit union to get those economies of scale, to pick up some functionality, and to handle the load on the organization.” – Bob Falk

- “The dollar is the most dominant currency in terms of how transactions are done worldwide. I expect a lot of competition to come up at a fast pace and are going to slowly but surely chip away at the dominance that dollar has. All this spending of trillions of dollars that we have done and probably need to keep doing is not going to help on that front. And it’s going to probably happen much faster than anybody thought because everybody thought that the only currency we need to worry about probably is the central bank currency of China. But there are digital players coming up, too, and they are going to challenge the dollar as well.” – Amit Seru

- “I think it’s going to be very difficult for credit unions to keep their bottom line because capital is going to be an issue because of the growth that we’ve seen and some of this stimulus money that’s coming in. We’ve grown 23%, and if we don’t see some that go back out, our capital ratio is going to be something to be concerned about. So I think keeping capital up is going to be a struggle next year. We’ll start seeing credit unions merge to try and resolve the issues and some of it just out of necessity.” – Dean Pielemeier

- “The reason for all this economic conversation we’re having is the health pandemic. And I think a year from now, we will see a widely available and affordable vaccine available. Our conversations next year will be about how we shore up that bottom line, and also about encouraging mobility, spending where possible, and continuing to support members where they need it most. From a cultural perspective, I expect that more of us will work remote and that there will be different ways of interacting with members that perhaps we haven’t even thought of yet. I think the face of our workforce and the face of our membership is going to change because conversations about racial and economic justice are going to continue. And I think ultimately that’s going to be a good thing.” – Erin Coleman

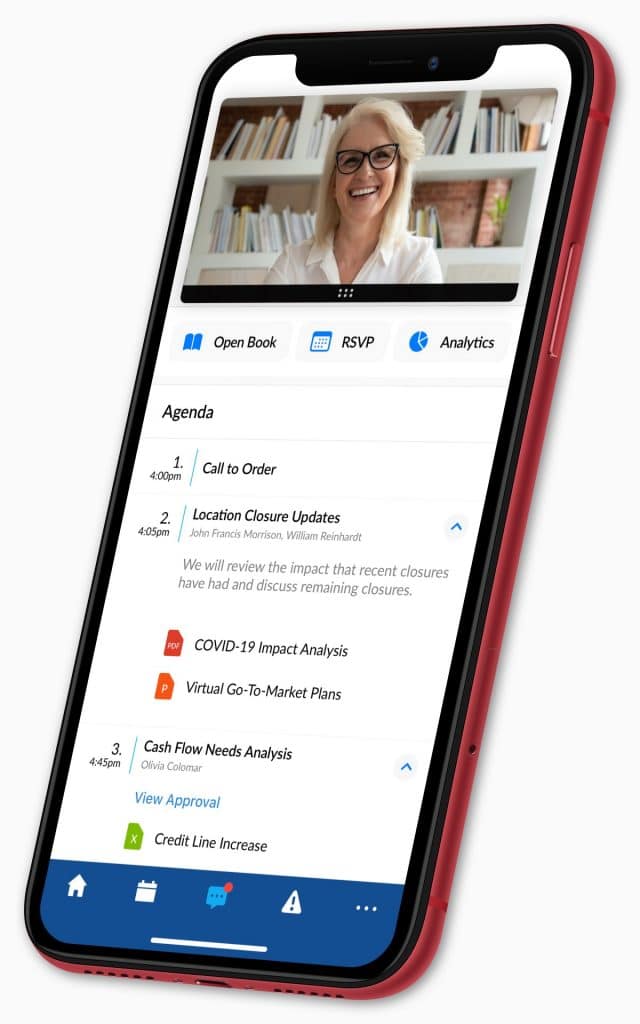

- “I predict the death of the privately-owned data centers. We’re starting to see the real grinding on that front.” – Paroon Chadha

Get Even More Insights!

Sign up for the latest news, productivity tips, events, OnBoard updates, and more. We promise to entertain, educate, and enlighten (and not always in that order).

About The Author

- At OnBoard, we believe board meetings should be informed, effective, and uncomplicated. That’s why we give boards and leadership teams an elegant solution that simplifies governance. With customers in higher education, nonprofit, health care systems, government, and corporate enterprise business, OnBoard is the leading board management provider.

Latest entries

Board Management SoftwareJuly 26, 20225 Critical Board Engagement Survey Questions

Board Management SoftwareJuly 26, 20225 Critical Board Engagement Survey Questions Board Management SoftwareJuly 19, 2022What is an Advisory Council? (Overview, Roles, and Responsibilities)

Board Management SoftwareJuly 19, 2022What is an Advisory Council? (Overview, Roles, and Responsibilities) Board Management SoftwareJuly 15, 2022Balance Sheet vs. Income Statement: What’s the Difference?

Board Management SoftwareJuly 15, 2022Balance Sheet vs. Income Statement: What’s the Difference? Board Management SoftwareJuly 12, 2022Sweat Equity: Mark Haas of the Dallas Cup Board Gives a Nonprofit Play-by-Play for Success

Board Management SoftwareJuly 12, 2022Sweat Equity: Mark Haas of the Dallas Cup Board Gives a Nonprofit Play-by-Play for Success