Nearly every organization seeks to increase staff productivity. Tools that can bolster how quickly employees can access and process information. Too often in pursuit, these organization choose quick fixes and stand alone solutions. However, a small but growing number of financial institutions have turned to a suite of tools, an intranet. Simplicity Credit Union sought to get the word out about their new Signature Loans campaign without sending staff an endless volume of emails that simply won’t get read – or talking about the campaign once in a meeting before it’s was never mentioned again.

Nearly every organization seeks to increase staff productivity. Tools that can bolster how quickly employees can access and process information. Too often in pursuit, these organization choose quick fixes and stand alone solutions. However, a small but growing number of financial institutions have turned to a suite of tools, an intranet. Simplicity Credit Union sought to get the word out about their new Signature Loans campaign without sending staff an endless volume of emails that simply won’t get read – or talking about the campaign once in a meeting before it’s was never mentioned again.

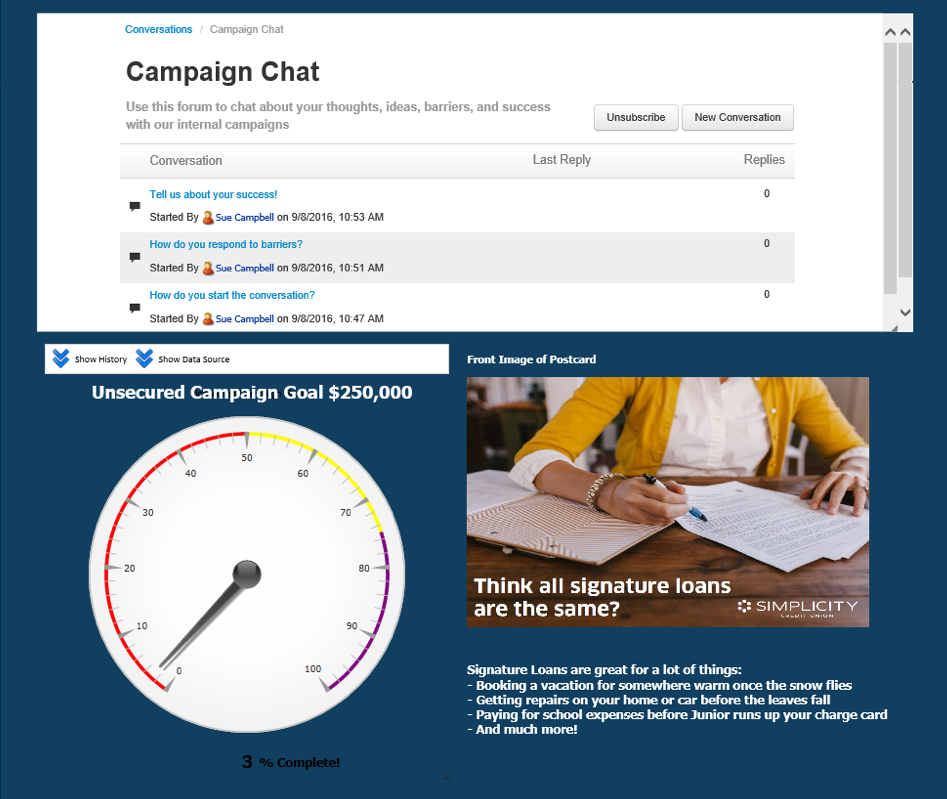

They used 3 simple tools:

- Dashboards

- Conversations

- Announcements

Their OnSemble Intranet seamlessly integrated these tools, motivating front end staff to achieve the campaigns goals for loan growth.

Within days of launching the campaign for Signature Loans you could hear staff talking about it being on the intranet. It was the buzz of the office, why?

Because as a result, Simplicity Credit Union achieved 90% of the $250,000 goal within 30 days.

The team is rolling out the next campaign of $750,000 in loans, 360 loans in total, within 8 weeks. Simplicity Credit Union has already achieved 21% of the goal!!!

Why did Simplicity Credit Union choose to implement OnSemble?

“Our intranet site had become just a big dumping ground of documents—just a big mess. It wasn’t user friendly, and wasn’t efficient. SharePoint was too complex and complicated,” said Darlyne Keller, VP of Administration, “You basically have to have someone highly-specialized and highly-trained to program and maintain the site. We didn’t have that expertise, nor did we want to invest the time and money to hire someone just for that purpose.”

“We looked at a couple other pre-built solutions. Their solutions might have worked for a much smaller group or some other industry, perhaps, but not necessarily a credit union like ours. They just didn’t offer the functionality and growth potential that Passageways did.” Darlyne and her team first heard about Passageways through a client webinar. “It really helped that Passageways was affiliated with CUNA and understood the credit union movement,” Darlene said, “It’s important to partner with someone who understands what you are trying to accomplish.”

All that was left was to pick the package that best fit. “We went with the Enterprise Package—all the bells and whistles and everything Passageways had to offer.” Darlyne said, “With the Enterprise Package there are tools other financial institutions use that we hadn’t even considered, such as Lobby Management and Learning Management. We even purchased the OnBoard board portal. We realized that just because you’ve gotten by without a feature in the past, it doesn’t mean it isn’t something you need to make your member service and your credit union as a whole the best it can be.”

About The Author

- At OnBoard, we believe board meetings should be informed, effective, and uncomplicated. That’s why we give boards and leadership teams an elegant solution that simplifies governance. With customers in higher education, nonprofit, health care systems, government, and corporate enterprise business, OnBoard is the leading board management provider.

Latest entries

Board Management SoftwareJuly 26, 20225 Critical Board Engagement Survey Questions

Board Management SoftwareJuly 26, 20225 Critical Board Engagement Survey Questions Board Management SoftwareJuly 19, 2022What is an Advisory Council? (Overview, Roles, and Responsibilities)

Board Management SoftwareJuly 19, 2022What is an Advisory Council? (Overview, Roles, and Responsibilities) Board Management SoftwareJuly 15, 2022Balance Sheet vs. Income Statement: What’s the Difference?

Board Management SoftwareJuly 15, 2022Balance Sheet vs. Income Statement: What’s the Difference? Board Management SoftwareJuly 12, 2022Sweat Equity: Mark Haas of the Dallas Cup Board Gives a Nonprofit Play-by-Play for Success

Board Management SoftwareJuly 12, 2022Sweat Equity: Mark Haas of the Dallas Cup Board Gives a Nonprofit Play-by-Play for Success